Shiv Nadar’s HCL Technologies has been the third largest IT company in India by revenue for the last four years. But the market never s...

Shiv Nadar’s HCL Technologies has been the third largest IT company in

India by revenue for the last four years. But the market never saw it

so, as Wipro had retained its position as the third-largest IT company

by market cap.

#Technology #News #InfoTech

It’s true no more as HCL Tech sprinted ahead of Wipro by a healthy margin with a market cap of over ₹2.5 lakh crore, compared to Wipro’s ₹2.2 lakh crore.

It’s worth noting that HCL Tech beat Wipro not because its shares surged this year – both the companies’ stocks have seen a massive drawdown this year. It’s just that HCL Tech’s shares have fallen much lower than Wipro.

It’s not just that these two companies have seen a meltdown. All IT stocks fell this year, with Wipro being the worst performer.

#Technology #News #InfoTech

It’s true no more as HCL Tech sprinted ahead of Wipro by a healthy margin with a market cap of over ₹2.5 lakh crore, compared to Wipro’s ₹2.2 lakh crore.

It’s worth noting that HCL Tech beat Wipro not because its shares surged this year – both the companies’ stocks have seen a massive drawdown this year. It’s just that HCL Tech’s shares have fallen much lower than Wipro.

It’s not just that these two companies have seen a meltdown. All IT stocks fell this year, with Wipro being the worst performer.

Young blood – relatively

HCL

Technologies is much younger than Wipro – founded in 1991, it’s a

30-year-old company, while Wipro is almost an octogenarian, as it was

founded in 1945 as a maker of vegetable oils.

It adapted to the changing business environment in the 1970s and 80s and transformed itself into an IT company.

It adapted to the changing business environment in the 1970s and 80s and transformed itself into an IT company.

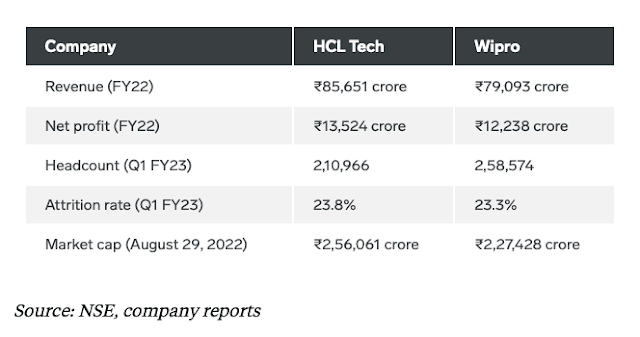

HCL Tech is also slightly leaner than Wipro in terms of operations, with a headcount of 2.1 lakh as against Wipro’s 2.5 lakh.

Here’s how the two companies stack up:

Source: NSE, company reports

High attrition rates,

supply chain issues, soaring inflation and the Russia-Ukraine war has

poured cold water on the Indian IT sector, which witnessed an

unprecedented boom in the past two years.

This resulted in JP Morgan downgrading the Indian IT sector

to “underweight” – the investment bank said in its report that the

revenue has peaked and margins will continue to be under stress. It also

noted that the slowdown could worsen in FY23 – and the June quarter results reflect this reality too.

No comments